Submission: Broadcasting Public Notice CRTC 2007-70

PROFITEERING IN THE NAME OF CULTURE

20 July 2007

Critical analysis of company subsidy program

Keith M. Mahar

"When people get to the real heart of how close the relationship has been between the cable industry and the CRTC, they'll want a public inquiry."

Statement by Keith M. Mahar

"Cable TV Firms Get $300m Windfall"

Antonia Zerbisias, The Toronto Star, 9 July 1995

CONTENTS

EXECUTIVE SUMMARY

1. INTRODUCTION

2. CRTC TASK FORCE REPORT

3. RESEARCH & ANALYSIS

4. POLICY EVALUATION CRITERIA

a) Redistribution of Wealth

b) Democratic Process

c) Regulatory Capture

d) Ethics

5. POLICY CHRONOLOGY

$100 Million Offer by Industry

Cable Production Fund

Company Subsidy Program

Inefficient by Design

Inequitable by Design

Violation of Government Policy (Phase 1)

Collection by Deception

Newmarket Case Study: January 1995

Violation of Government Policy (Phase 2)

False & Misleading Statements

Complaint of Illegal Activities

Newmarket Case Study: January 1996

Unpublished CRTC Decision (File 1000-121)

Violation of Government Policy (Phase 3)

Canada Television and Cable Production Fund

Power of Public Servants

Broadcasting Distribution Regulations

Newmarket Case Study: January 1998

Canadian Television Fund

Ongoing Subsidies to Companies

7. OUTSTANDING ISSUES

8. CONCLUSION

9. RECOMMENDATIONS

10. APPENDICES

"When people get to the real heart of how close the relationship has been between the cable industry and the CRTC, they'll want a public inquiry."

Statement by Keith M. Mahar

"Cable TV Firms Get $300m Windfall'

Antonia Zerbisias, The Toronto Star, 9 July 1995

EXECUTIVE SUMMARY

Research of documents, including an unpublished CRTC decision (File 1000-121), information obtained from Allan J. Darling while he was Secretary General to the Canadian Radio-television and Telecommunications Commission (CRTC), and data from the CRTC's Access to Information and Privacy Coordinator, identifies inherent deficiencies in the policy framework of the Canadian Television Fund.

Findings include:

· violation of Government policies by CRTC

· unaccounted funds retained by corporations

· high inefficiency by design

· false and misleading statements made by CRTC to elected representatives and media

· enrichment of corporations by hundreds of millions of dollars by CRTC for unspecified purpose, without the companies being required to do any work for the revenue.

Recommendations include a judicial review of activities by the CRTC and corporations; restructuring the Canadian Television Fund into a government program which is funded entirely through Parliament; subsidies to production companies changed from non-repayable grants to equity investment; and adopting measures to introduce democratic integrity into the CRTC process, such as the creation of a Citizen Utility Board to empower citizens to better protect their interests.

Keith M. Mahar was formerly employed in the Canadian broadcasting industry for his specialist knowledge of the cable television industry and its regulation by the CRTC. As a public interest litigant, his pro bono legal team of Christopher K. Leafloor, Neil Milton and J. Blair Drummie won a precedent-setting legal decision on costs in Mahar v. Rogers Cablesystems Ltd. in 1995, a legal case related to the Cable Production Fund. He holds a BBA (Distinction) from the University of New Brunswick and is presently studying social work at the Australian Catholic University in Canberra.

"Have you got any plausible vocabulary to sell this to the public? Very often words matter."

Statement by CRTC Chairman Keith Spicer to industry representatives

Public Hearing on Convergence, 9 March 1995

1. INTRODUCTION

Is there evidence that the Canadian Television Fund does not qualify as good policy?

According to a recent press release by the Canadian Television Fund, the industry-government partnership has contributed $2.22 billion to production companies over the last ten years to support 4,470 productions, funding which has resulted in more than 23,000 hours of television for Canadians, and triggered more than 7.4 billion dollars in production volume across the country.1

In addition, it is the assertion of the industry-government partnership that the Canadian Television Fund plays a vital role in Canada's cultural landscape, and that the initiative strengthens the sense of community. Moreover, according to the Canadian Television Fund, the subsidies distributed by the industry-government partnership to production companies are "financed by contributions from the Government of Canada, the Canadian cable and direct-to-home satellite industries and Telefilm Canada."2

Furthermore, the publicly stated objectives of the Canadian Television Fund appear to be legitimate.

1. "To encourage the financing and broadcasting of high-quality Canadian television productions.

2. To reflect Canada to Canadians by assisting the creation and broadcast, in prime time, of high-quality, culturally significant Canadian programs in both official languages in the genres of drama, children's, documentaries and variety and performing arts, and by both majority and minority official-language sectors.

3. To support Aboriginal language productions in the eligible genres."3

2. CRTC TASK FORCE REPORT

Not everyone, however, is sold on the merits of the Canadian Television Fund in its present form. In response to concerns raised by Shaw Communications Inc. (Shaw) and Quebecor Inc. (Quebecor) regarding the operations and governance of the Canadian Television Fund, the Canadian Radio-television and Telecommunications Commission (CRTC or Commission) established its Task Force on 20 February 2007. As reported by the CRTC, between 22 February and 8 May 2007, the Task Force met with 61 groups and 144 individuals representing all sectors of the Canadian television industry behind closed doors, on a

confidential basis, and without notes being taken during the meetings,4 while citizens were excluded from participating in the consultation process.5 The process resulted in the `Report of the CRTC Task Force on the Canadian Television Fund', published on 29 June 2007.

Material facts related to the Canadian Television Fund were omitted by the public servants who wrote the CRTC report. Owing to the nature of the omissions, readers of the report are not in a position to properly assess the industry-government partnership. As a result, elected representatives cannot make informed decisions on the Canadian Television Fund on the basis of the information provided in the report by public servants. In addition, the omissions serve to limit the accountability of its policymakers. Consequently, the failure by the CRTC Task Force to report factual material pertaining to the policy has undermined the integrity of the democratic process in this matter.

3. RESEARCH & ANALYSIS

As addressed in the 29 June 2007 report by the CRTC Task Force, the Canadian Television Fund began its existence as the Cable Production Fund. It is not possible to understand the present policy framework without understanding the decisions made by the CRTC in relation to the Cable Production Fund, and the Canada Television and Cable Production Fund, decisions which continue to shape and influence the industry-government partnership.

A comprehensive understanding of the policy is not possible by simply reviewing CRTC published documents. In addition to public documents available in relation to the production funds, research findings for this report rely upon other various documents, including the unpublished CRTC decision made on 25 June 1996, an unorthodox regulatory decision which has underpinned all three production funds over the last 11 years. CRTC File 1000-121 has been attached to this report as Appendix A.

In order to clarify the effects of the production fund policies on consumers and companies, financial data is used which was obtained directly from Allan J. Darling, while he was Secretary General to the Commission, and from Betty MacPhee, while she was the CRTC's Access to Information and Privacy Coordinator. These documents are attached as Appendix B and Appendix C, respectively.

Furthermore, Cable Watch Citizens' Association (Cable Watch) filed an official complaint to the CRTC on 28 November 1995 alleging that activities by the Commission and corporations in relation to the Cable Production Fund were illegal. The complaint is attached as Appendix I and the subsequent submission made by Cable Watch to the CRTC on 20 May 1996 has been attached as Appendix D.

This report documents significant factual material on the program production fund policy which was omitted in the report by the CRTC Task Force. In addition, the information is supplemented by analysis of the precise effect of the policy on a citizen purchasing basic cable service from Rogers Cable TV (Rogers) in Newmarket, Ontario at different points in time. The case study analysis helps to clearly illuminate the workings of the policy.

5. POLICY EVALUATION CRITERIA

One purpose of this research report is to permit readers to identify if the Canadian Television Fund policy suffers from any significant defects. As addressed below, there are experts who question the purpose of Canadian content regulations, who dismiss the integrity of regulatory agencies, including the CRTC specifically, who view industry-government partnerships as a threat to the democratic process, and who allege that the Canadian system encourages dishonest and unethical behaviour from corporate executives, bureaucrats and politicians.

a) Redistribution of Wealth

In a 1996 publication by the Institute for Research on Public Policy, Professors Steven Globerman, Hudson N. Janisch and William T. Stanbury stated that the majority of economists consider the purpose of Canadian content regulation is to redistribute wealth to members of a politically influential industrial sector. "It must be emphasized that none of the many regulations to which broadcasters (or other `distribution 2 undertakings') are subject seek to specify the themes, subject matter or substantive content of program

material. `Canadian' programs are simply those that are made by persons who are Canadian citizens. It is for that reason that most economists think of Cancon regulations as `boiling down' to yet another case of a small, well organized group using the power of the state to redistribute income to themselves."6

b) Democratic Process

Professor Joel Bakan alleged in The Corporation that industry-government partnerships are a threat to the democratic process.

"Though corporations have a place in representing their concerns to government and cooperating with government on policy initiatives, the special status they currently enjoy as "partners" with government endangers the democratic process. At a minimum, their influence should be scaled back to a degree more commensurate with other organizations, such as unions, environment and consumer groups, and human rights advocates." 7

c) Regulatory Capture

Professor G. William Domhoff addressed in The Powers That Be that corporations and industry sectors in the United States of America are able to secure subsidies and procedural rulings from regulatory agencies through a number of means, including "gifts, bribes, insider dealing, friendship [and], not least, promises of lucrative private jobs in the future for compliant government officials."8 Domhoff stated that American regulatory agencies are often captured by the industries that they are expected to regulate.

"It is commonplace that regulatory agencies are often controlled by the businesses they are supposed to regulate. Just about every study acknowledges or demonstrates that point. Nor are the mechanisms of this domination unfamiliar. Many of the agency leaders come directly from the regulated industry. Conversely, longtime agency employees often leave to work for a law firm which represents clients before the agency, or for businesses supposedly being regulated by it. The studies also provide other reasons Â- the agencies are understaffed, they are harassed by congressional committees that look out for special interest, they are influenced by lobbyists, and information is withheld from them by the businesses themselves."9

One CRTC expert has recently said that the same kind of analysis holds true in the case of the Canadian federal regulator. In 2000, Matthew Fraser, a Professor at the time and a former CRTC employee, wrote an article for The Financial Post in which he alleged that the CRTC had been totally captured by industry interests by the late 1980s and was "cursed by institutionalized corruption."10

"According to the theory of `regulatory capture,' bodies such as the CRTC go through successive stages toward their own inevitable corruption. In their infancy, regulators show youthful activism. By middle age, they have succumbed to subtle co-option by industry interests. In their final stage of bureaucratic senility, they degenerate into passive instruments of the corporate interests under their purview.

It would take formidable powers of self-delusion to deny that the CRTC's evolution has followed the capture theory with alarming fidelity. Created in 1968, the commission was already slipping into complicity with industry interests by the late 1970s. A decade later, it was totally captured. This was especially true in broadcasting."11

d) Ethics

According to the non-profit organization Democracy Watch, there are structural deficits in the Canadian system in terms of government and corporate accountability, ethics and honesty which cost citizens in a number of ways.

"The System is the Scandal! and no one should be surprised that governments, politicians, government employees, corporations and big business executives act dishonestly, unethically, secretively, non-representatively or wastefully  the system encourages them to do so through weak rules, weak enforcement, and weak penalties.

This is not at all to say that all, most or even many politicians, government employees or corporate executives are dishonest, unethical, secretive, non-representative or wasteful  but if any of these people act in these ways they will often not be caught, let alone penalized, because of loopholes in laws and rules and weak enforcement systems.

Incredibly, the laws and enforcement of parking a car illegally are stronger than most government accountability and corporate responsibility laws and enforcement systems in Canada, and in some cases the penalties for parking illegally are higher than for government officials or corporate executives who act dishonestly, unethically, unrepresentatively, secretively or wastefully!"12

For the purpose of this research, the appropriateness of distributing $2.2 billion in subsidies to private production companies is essentially ignored, as focusing on the policy from a cable industry and consumer perspective provides sufficient findings to permit a conclusion and recommendations.

6. POLICY CHRONOLOGY

$100 Million Offer by Industry

The concept of a program production fund was originally proposed by the cable industry. On 5 February 1993 the Canadian Cable Television Association (CCTA) notified the CRTC that cable companies were prepared to collectively contribute up to $100 million to subsidize private Canadian production companies if the CRTC changed its regulations as proposed by industry.13 The regulatory changes proposed by the CCTA were designed to permit corporations to charge consumers higher future cable fees than possible under the law at the time.

Canadian-owned production companies, such as Alliance Communications Corporation and Atlantis Films Limited, supported the cable industry proposal, but lobbied the CRTC for more than $100 million for production companies, and wanted subsidies which did not require repayment.14

Cable Production Fund

On 3 June 1993 the CRTC announced that it had made a decision to create the Cable Production Fund and change its regulations by adding subsection 18 (6.3) of the Cable Television Regulations, 1986 (hereinafter the "Diversion Clause"), subordinate legislation which was enacted on 25 January 1994.15 According to the Commission, the purpose of the adoption of the Diversion Clause was to support Canadian programming.

"...the Commission by majority vote, intends to make certain changes to its cable rate regulation mechanisms, the purpose of which is to provide significant financial support for Canadian programming."16

Company Subsidy Program

However, the Diversion Clause did more than support the production of Canadian programming, it also empowered cable television companies to require citizens purchasing their service to subsidize the operations of production companies and their own business (hereinafter the "company subsidy program"), commencing 1 January 1995. CRTC officials designed the company subsidy program to be financed by consumers paying artificially inflated rates for basic cable service, a federally-regulated monopoly service.

According to CRTC information, the company subsidy program was estimated to pay for approximately $300 million in non-repayable grants to production companies over the 5-year period starting 1 January 1995. During the same period, however, the CRTC company subsidy program was also designed to enrich corporations operating cable companies by $300 million; without the statutory monopolies being required to do any work for the revenue.17

In addition, the design of the policy actually required ratepayers to pay provincial sales tax (PST) and federal goods and services tax (GST) on their financial contributions paid to subsidize the companies, since the cost of the company subsidy program was included in the monthly rate for basic cable service.

Furthermore, the CRTC policy was designed with a built-in cost escalator to increase the monthly cost of the company subsidy program to Canadian consumers over time.

Inefficient by Design

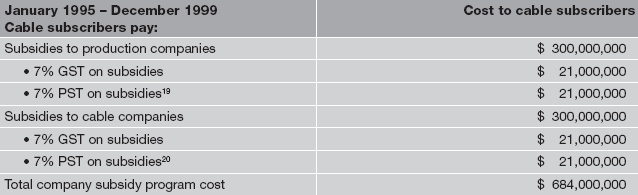

In terms of its stated purpose of supporting Canadian programming, the company subsidy program was inherently inefficient. As documented in Table 1, the CRTC decision required cable subscribers to pay approximately $684 million over the first five years in order to raise $300 million in subsidies to production companies.

Table 1. Costs to cable subscribers which underpinned the CRTC decision to adopt the company subsidy program policy18

Sources: CRTC Public Notice 1993-74, 3 June 1993; Cable Television Regulations, 1986.

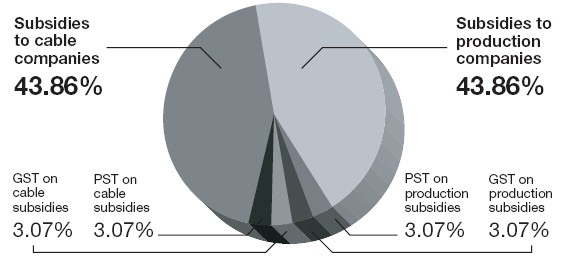

The beneficiaries of the inefficiency were cable companies, who retained more than 43 percent of the total cost to consumers without being required to do anything for the revenue.

Graph 1.The company subsidy program was designed by the CRTC so that less than 44 percent of its total cost to cable subscribers subsidized production companies21 22

Inequitable by Design

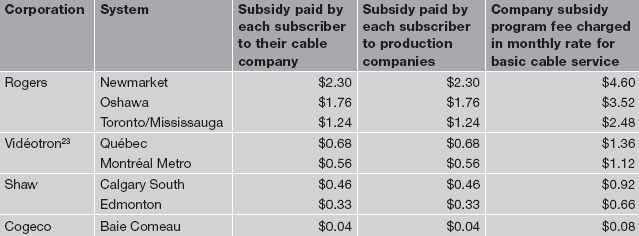

In addition to being grossly inefficient, the company subsidy program was also designed by public servants at the CRTC to be highly inequitable.

For example, consider the actual monthly cost of the company subsidy program in January 1995 to subscribers in eight different systems. Consumers in Newmarket, Ontario paid more than 57 times the amount in subsidies than consumers in Baie Comeau for exactly the same Cable Production Fund. Moreover, Rogers made $2.30 for each Newmarket subscribers without being required to do anything for the revenue, while Cogeco only pocketed $0.04 per subscriber for doing nothing.

Table 2. Actual January 1995 cost of the company subsidy program to cable subscribers in selected cable systems (excluding PST & GST)

Sources: Allan J. Darling, Secretary General to the Commission,24 July 1995, (Appendix B); Cable Television Regulations,1986.

Violation of Government Policy by CRTC (Phase 1)

Furthermore, the company subsidy program did not conform to Government policy, which required that "[p]articipants in the Information Highway make equitable and appropriate contributions to the production and distribution of and access to Canadian-cultural-content products and services [and for regulation] to foster fair competition..."24

Collection by Deception

Cable subscribers started paying for the company subsidy program in January 1995 but did not object to their cable companies. The statutory monopolies had notified consumers that the company subsidy program fee was being collected for an entirely different purpose. Ratepayers had been notified that the fee was to permit cable companies to partially recover capital expenditure costs which were required to provide basic cable service.25

Newmarket Case Study (1): January 1995

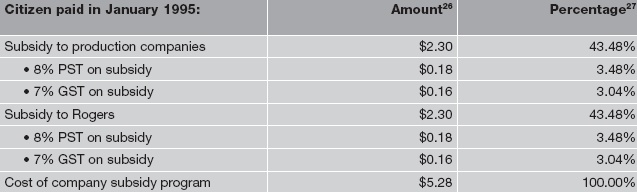

For purpose of clarity, consider the exact effect of the company subsidy program on a citizen in Newmarket, Ontario who purchased basic cable service from Rogers for the month of January 1995.

In addition to being required to pay $4.30 in subsidies for Rogers and production companies, the citizen was required to pay a total of $0.68 in GST and PST on the amount he/she paid to subsidize the private companies. Furthermore, the cost of the company subsidy program was collected under the false pretence of being a fee to permit Rogers to partially recover a portion of its cost for capital expenditures which were required in the provision of basic cable service.

Table 3. Actual January 1995 cost of company subsidy program to a citizen in Newmarket, Ontario purchasing basic cable service from Rogers

Table 3 Sources: Allan J. Darling, Secretary General to the Commission, 24 July 1995. (Appendix B); Cable Television Regulations, 1986.

Violation of Government Policy (Phase 2)

On 24 March 1995 the CRTC issued Circular 410 to cable companies, notifying the statutory monopolies that they were not required to account for the portion of the company subsidy program that they retained for themselves, revenue retained without the requirement of doing any work.28

Consequently, the cable companies were not required to spend their cable subscriber-financed subsidy on anything to do with cable television. In effect, the CRTC was fostering cross-subsidization and unfair competition, contrary to Government policy.

Rogers was a major beneficiary of the breach of Government policy by the public servants at the CRTC because the policy permitted Rogers to charge its customers higher subsidies per subscriber than other cable companies.

False & Misleading Statements

Less than three months after citizens started paying for the company subsidy program, three members of Parliament participated in a non-partisan press conference and called on the Chrétien government to review the decision by the CRTC to adopt the company subsidy program.29

In response, the CRTC issued a news release containing false and misleading information on the subject to Canadian journalists, falsely stating, "[t]he Commission authorizes rates for basic cable services, which reflect necessary capital investments, as well as the costs of programming distributed by the cable companies."30 As documented, 50 percent of the company subsidy program monthly fee which was being paid by subscribers was being retained by cable companies without being required to account for its use, or do any work for the revenue.

MP Dan McTeague issued a news release specifically to address the misleading nature of the CRTC press release, and stated, "[t]he press release issued yesterday by the CRTC denying the existence of a hidden tax on cable TV subscribers is misleading on several fronts... [t]he CRTC has been playing fast and loose for some time with the money of Canadian cable subscribers and now they are doing the same thing with the truth."31

CRTC Chairman Keith Spicer subsequently testified before the Standing Committee on Canadian Heritage that Canadians had been notified of its company subsidy program.

Mr. McTeague: "Did you give notice to Canadians that this was going to happen?"

Mr. Spicer: "Oh, yes, we did."32

While giving evidence to the same parliamentary committee at a later date, Mr. Spicer testified to the elected representatives that cable companies were only able to retain their 50 percent of the company subsidy program monthly fee if the corporations used the money for capital.33 The statement made by the public servant was false.

Complaint of Illegal Activities

An official complaint was filed to the CRTC by Cable Watch Citizens' Association (Cable Watch) on 28 November 1995, pursuant to s.12 of the Broadcasting Act. In the complaint, Cable Watch stated that the CRTC and cable companies had acted illegally in relation to the company subsidy program, and requested the Commission to call a public hearing into the matter.34

The Public Interest Advocacy Centre (PIAC) requested the Minister of Canadian Heritage to "swiftly take steps to initiate an independent review" of the complaint.35

However, the Chretien government did not initiate an independent review of the complaint as requested by PIAC.

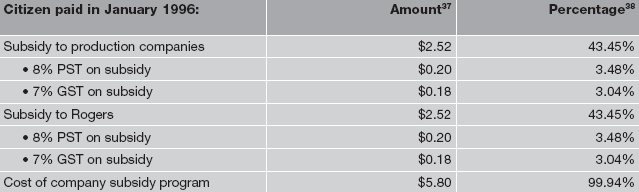

Newmarket Case Study: January 1996

The actual cost of the company subsidy program in January 1996 to cable subscribers in Newmarket was provided by the CRTC Access to Information and Privacy Coordinator.

"The January 1996 cable rate for Newmarket, Ontario would be $22.65 if Rogers contributes to the Cable Production Fund and $17.61 if it doesn't."36

At that time, the company subsidy program monthly fee hidden in the basic cable rate was $5.04, accounting for more than 22 per cent of the cost of basic cable service. Including PST and GST, the total monthly cost of the undisclosed company subsidy program was $5.80 per subscriber.

Table 4. Actual January 1996 cost of company subsidy program to citizen in Newmarket, Ontario purchasing basic cable service from Rogers

Sources: Betty MacPhee, CRTC Access to Information and Privacy Coordinator, 19 January 1996 (Appendix C). Cable Television Regulations, 1986.

Unpublished CRTC Decision (File 1000-121)

On 25 June 1996 the CRTC notified Cable Watch's legal counsel that the Commission had ruled itself and cable companies innocent of illegal activity related to the company subsidy program. The decision was made behind closed doors and was not published.39

In essence, the CRTC had ruled that Parliament had granted it the statutory authority to require citizens to pay subsidies to the companies; ratepayers paying the subsidies were not entitled to written notice of the fact that they were being required to pay the subsidies, or informed of the monthly cost; it was appropriate for citizens to be required to pay inequitable subsidies to the companies; it was appropriate that cable companies retained 50 percent of the monthly company subsidy program monthly fee for unspecified purposes, without doing any work for the revenue; and ratepayers of the company subsidy program were

not entitled to refunds by their cable companies.

The ruling by the public servants at the CRTC that the CRTC and corporations were innocent of illegal activity was never subjected to a judicial review by the Federal Court of Appeal, therefore the legality of the activities remains a matter of debate.

The unpublished and legally ambiguous decision made by the public servants has underpinned the policy framework of the Cable Production Fund, Canada Television and Cable Production Fund, and the Canadian Television Fund.

Violation of Government Policy (Phase 3)

On 6 August 1996 Deputy Prime Minister and Minister of Canadian Heritage Sheila Copps and Industry Minister John Manley announced the policy framework on convergence.40

In addition to re-stating that equitable contributions to support Canadian programming and fostering fair competition was Government policy, additional policies were adopted too. It also became Government policy that CRTC regulations should prevent cross subsidies from monopoly or utility services, and that "regulation must ensure that the gross revenues from broadcasting activities are fully identified and accounted."41

However, the CRTC did not change its company subsidy program to conform to Government policy.

Canada Television and Cable Production Fund

Following the refusal of the Chrétien government to initiate an independent review of the company subsidy program, Deputy Prime Minister and Canadian Heritage Minister Sheila Copps announced the establishment of the Canada Television and Cable Production Fund on 9 September 1996. The industry-government partnership between Canadian Heritage and the cable industry was based upon revenue being obtained from citizens under false pretence in relation to the company subsidy program.

Power of Public Servants

The history of the company subsidy program also demonstrates the power of public servants in Canada. For example, Fernand Bélisle, then CRTC Vice-Chairman of Broadcasting, appeared before the Standing Committee on Canadian Heritage on 25 April 1996. At that time, MP Jim Abbott tried to persuade Mr. Bléisle to make a commitment to the parliamentary committee that the CRTC was going to request cable companies participating in the company subsidy program to notify their subscribers of the program and its monthly cost. The public servant refused to make such a commitment to the elected representative, stating that the CRTC would consider his request.42

Nearly six months later, MP Dan McTeague appeared at a CRTC public hearing and urged the CRTC to ensure that citizens paying for the company subsidy program were notified of the program and its cost.43

Consumers were never notified about the company subsidy program or its monthly cost.

Broadcasting Distribution Regulations

In mid-1996 the CRTC proposed to adopt the Broadcasting Distribution Regulations and was informed at its October 1996 public hearing that its proposed changes violated Government policy by fostering unfair competition, did not account for broadcasting revenue, would result in inequitable contributions to the program production fund, and was incorporating major regulatory deficiencies into the future.44 Despite the facts, the CRTC subsequently adopted the Broadcasting Distribution Regulations, which came into effect on 1 January 1998.

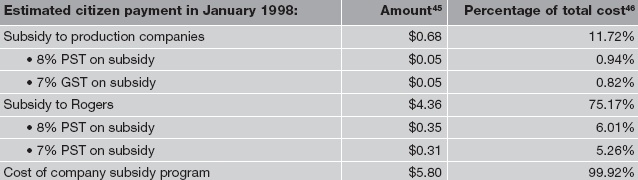

Newmarket Case Study: January 1998

The actual monthly figures for Newmarket, Ontario for January 1998 are being requested from the CRTC.

For the purpose of comparison, the figures in Table 5 assume that the January 1998 basic cable rate had remained at $22.65 since January 1996. The new regulations required Rogers to pay a minimum of 3 percent of its gross revenue to a production fund, which is $0.68 for the basic cable subscriber.

Table 5. Estimate of the January 1998 impact of the introduction of the Broadcasting Distribution Regulations to a citizen in Newmarket, Ontario purchasing basic cable service from Rogers

Sources: Betty MacPhee, CRTC Access to Information and Privacy Coordinator, 19 January 1996 (Appendix C); Cable Television Regulations, 1986; Broadcasting Distribution Regulations.

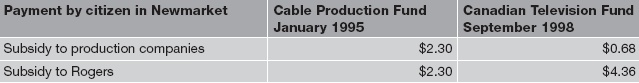

Canadian Television Fund

On 17 September 1998 the Canada Television and Cable Production Fund changed its name to the Canadian Television Fund. The name change did not alter the accounting of the company subsidy program or stop corporations from profiteering from its existence.

Table 6. Comparison of monthly subsidies paid by a citizen in Newmarket, Ontario in January 1995 and September 1998

Sources: Allan J. Darling, Secretary General to the Commission, 24 July 1995, (Appendix B); Betty MacPhee, CRTC Access to Information and Privacy Coordinator, 19 January 1996 (Appendix C); Cable Television Regulations, 1986; Broadcasting Distribution Regulations.

Ongoing Subsidies to Companies

As a result of the decision by the CRTC to de-regulate rates for basic cable service, it is difficult to identify the exact monthly cost of the subsidies currently being paid. However, it is fair to state that the 3 percent charge on gross broadcasting revenue is being passed on to consumers, and that they are being charged GST and PST on top of that amount. Furthermore, in the absence of rate reductions by cable companies equal to the amount of the former company subsidy monthly fees, it is reasonable to conclude that the subsidies are still being collected from consumers in the form of artificially inflated rates for cable

television service.

7. OUTSTANDING ISSUES

Are public servants in Canada empowered to act as the CRTC officials have? The legal authority of the CRTC to impose the company subsidy program on citizens remains unresolved and the democratic principles of the case warrant clarification in the public interest.

Moreover, the legal entitlement of millions of citizens to retroactive rate refunds by the corporations which collected the fees under false pretence also remains unresolved.

Furthermore, given the lack of regard demonstrated by public servants at the CRTC in terms of improperly enriching cable companies, it is reasonable to review the value for money inherent in the $2.2 billion distributed to production companies over the last decade.

8. CONCLUSION

The research findings documented in this report provide conclusive evidence that public servants abused the statutory authority of the CRTC in order to redistribute wealth from ordinary citizens to corporations, supporting the statement made by Professors Steven Globerman, Hudson N. Janisch and William T. Stanbury with respect to the role of Canadian-content regulations. In addition, the assertion made by Professor Domhoff that American industry is able to secure subsidies from regulatory agencies in a number of ways was established to be correct in this particular Canadian case.

Moreover, the company subsidy program created by the CRTC improperly enriched some cable companies significantly more on a per subscriber basis than other corporations. Data obtained from the Secretary General to the Commission and the CRTC's Access to Information and Privacy Coordinator illustrates that the structure of the original policy permitted Rogers to retain more revenue per subscriber than other companies, and the corporation's customers were required to pay the highest price for the company subsidy program.

Given the enrichment of the corporations without the commercial entities being required to do any work for the revenue, it is fair to characterize the monies retained under the company subsidy program as profiteering. Furthermore, since the public servants and corporations acted deceptively and unethically in order to conceal the true nature of the program, the allegations made by Democracy Watch regarding unacceptable standards of government and corporate ethics in Canada is validated.

Furthermore, the fact that the scheme has operated for more than a decade with the direct involvement of Canadian Heritage lends support to Professor Bakan's allegation that industry-government partnerships undermine the democratic process. Matthew Fraser's belief that the CRTC has been totally captured by industry is substantiated beyond any reasonable doubt by the findings. It is fair to conclude that the Canadian Television Fund was designed to facilitate corporate profiteering in the name of culture.

9. RECOMMENDATIONS

1) A judicial review be conducted into the outstanding legal issues of the company subsidy program.

2) Creation of Citizen Utility Board legislation by Government and other measures to help remedy the corporate-bias in the CRTC's quasi-judicial decision-making process.

3) Transform the Canadian Television Fund into a government agency because there is no genuine benefit to the public from industry being a partner in the initiative; the Fund is financed entirely by consumers and taxpayers and industry has no legitimate role to play in its operation.

4) The CRTC to hold a public hearing to review its regulation of Canadian content, fostering

participation of Canadians in the regulatory process by instructing broadcasting distribution

undertakings to notify consumers how they have been forced to pay subsides since 1995.

5) Restructure the financing of the Canadian Television Fund so that it is totally financed by taxpayers, thereby stopping citizens from being required to pay GST and PST on top of the cost of the subsidies they presently pay production companies through artificially inflated rates for cable service.

6) Corporations should not be permitted to deduct contributions to the Canadian Television Fund as expenses for the purpose of reducing their corporate income tax; the Fund is financed entirely by consumers and taxpayers.

7) Representation of consumer and taxpayer groups on the Board of the Canadian Television Fund as long as it is an industry-government partnership, as the initiative is financed entirely by consumers and taxpayers.

8) Change the subsidies to production companies from being non-repayable grants to equity

investments, in order to maximize value for money to ratepayers, increase sustainability and amount of potential funding, and reduce opportunity for abuse by companies.

10. APPENDICIES

Copies of the appendices noted in this report are posted electronically on the CRTC's public record. To view -click here

1 Canadian Television Fund, `CFT Welcomes CRTC Initiative', press release, Toronto, 21 February 2007.

2 Available online: http//.www.canadiantelevisionfund.ca. Accessed on 13 July 2007.

3 Ibid.

4 CRTC, `Report of the CRTC Task Force on the Canadian Television Fund', 29 June 2007.

5 Emails from John Keogh, Senior General Counsel, CRTC, 13 April and 2 May 2007

6 Steven Globerman, Hudson N. Janisch & William T. Stanbury, `Convergence, Competition and Canadian Content' in Perspectives on the New Economics and Regulation of Telecommunications, Montreal: Institute for Research on Public Policy, 1996, p.217.

7 Joel Bakan, The Corporation: The Pathological Pursuit of Profit and Power. Toronto: Penguin, 2004, pp.162-63.

8 G. William Domhoff, The Powers That Be: Processes of Ruling Class Domination in America. New York: Random House, 1979, p.25.

9 Ibid., pp.31-32.

10 Matthew Fraser, `The Man Who Won't Do Lunch', Financial Post, 10 June 2000. Fraser was a professor of communications at Ryerson University at the time, and formerly a CRTC employee.

11 Ibid.

12 Democracy Watch, online access, 15 July 2007, http://www.dwatch.ca/Clean_up_the_System.html

13 Canadian Cable Television Association, `A View to the Future  Step II', submission re Notice of Public Hearing CRTC 1992-13, 5 February 1993.

14 Transcript of CRTC Public Hearing, 22 and 25 March 1993.

15 Canada Gazette, SOR/94-133, Part II, vol. 128, no. 3, January 25, 1994, pp. 995, 999-1000.

16 CRTC, `Public Notice CRTC 1993-74', 3 June 1993, pp.16-18

17 CRTC Public Notice 1993-74, 3 June 1993; Cable Television Regulations, 1986.

18 Based on information provided in Public Notice CRTC 1993-74, dated 3 June 1993, and Cable Television Regulations, 1986,

including subsections 18(6), (6.1), (6.2) and (6.3).

19 PST figure is a weighted average calculated due to different rates in provinces and territories.

20 Ibid.

21 Rounded to 2 decimal places.

22 Based on information provided in Public Notice CRTC 1993-74, 3 June 1993, and Cable Television Regulations, 1986.

23 Vidéotron was subsequently purchased by Quebecor Inc.

24 Governor in Council, Order in Council P.C.1994-1689, 11 October 1994.

25 Cable Watch Citizens' Association (Cable Watch), complaint filed to CRTC pursuant to s. 12 of the Broadcasting Act, 28 November 1995, and Cable Watch submission to CRTC, 20 May 1996. Copies are attached as Appendix I and D, respectively.

26 Figures rounded to 2 decimal places where necessary.

27 Figures calculated on basis of non-rounded cost figures and rounded to 2 decimal places where necessary.

28 CRTC, Circular 410, `Cable Production Fund Contribution Guidelines', 24 March 1995.

29 Office of Simon de Jong, M.P., revised press advisory, `Hidden Cable Tax on Cable Consumers', re: press conference of Wednesday 29 March 1995, at the Charles Lynch Press Gallery (Centre Block), participants listed: Simon de Jong, NDP Critic Canadian Heritage, Jan Brown, Reform Critic Canadian Heritage, Dan McTeague, Liberal MP, Member Canadian Heritage Committee, consumer advocate Keith Mahar, Christopher Leafloor and Neil Milton, legal counsel to Mahar, and a representative from Democracy Watch.

30 CRTC, Public Affairs, news release, `CRTC statement on al egations of hidden tax', 29 March 1995. A copy is attached as Appendix E.

31 Dan Mcteague, M.P., Ontario Riding, news release, `CRTC denial of hidden tax on cable TV subscribers is misleading', 30 March 1995. A copy is attached as Appendix F.

32 Standing Committee on Canadian Heritage, evidence, Tuesday, 16 May, 1995, p.84:16. A copy of the transcript is attached as Appendix G.

33 Standing Committee on Canadian Heritage, evidence, Thursday, 25 April 1996. A copy of the transcript is attached as Appendix H.

34 Cable Watch Citizens' Association, complaint filed to CRTC Chairman Keith Spicer pursuant to s.12 of the Broadcasting Act, 28 November 1995. A copy is attached as Appendix I. In addition, its submission of evidence of potential illegal activities filed to the CRTC on 20 May 1996 is attached as Appendix D.

35 Letter by Michael Janigan, Executive Director/General Counsel, Public Interest Advocacy Centre, to Hon. Michel Dupuy, Minister of Canadian Heritage, copied to The Honourable John Manley, Minister of Industry, and CRTC Chairman Keith Spicer, 30 November 1995. A copy attached as Appendix J.

36 Letter from Betty MacPhee, Access to Information and Privacy Coordinator, CRTC, 19 January 1996. Attached as Appendix C.

37 Rounded to 2 decimal places where necessary.

38 Calculated on basis of un-rounded cost figures, percentages shown are rounded to 2 decimal places where necessary.

39 Allan J. Darling, Secretary General to the Commission, `Re: Complaint filed by Cable Watch', CRTC file 1000-121, 25 June 1996. A copy is attached as Appendix A.

40 Canadian Heritage, `Competition and Culture Set to Gain in Convergence Policy Framework', news release, 6 August 1996.

41 Deputy Prime Minister and Heritage Minister Sheila Copps and Industry Minister John Manley announced convergence policy and principles, `Convergence Policy Statement', 6 August 1996.

42 Standing Committee on Canadian Heritage, evidence, Thursday 25 April 1996. A copy of the transcript is attached as Appendix H.

43 MP Dan McTeague, transcript of CRTC proceedings, `The Regulation of Broadcasting Distribution Undertakings', Hull, 15 October 1996, pp.1523-65. A copy is attached as Appendix K

44 Ibid. Keith Mahar appeared before the CRTC with MP Dan McTeague on 15 October 1996.

45 Rounded to 2 decimal places where necessary.

46 Calculated on basis of non-rounded cost figures, percentages shown are rounded to 2 decimal places where necessary.